A friend asked, several fund companies have issued announcements to reduce the fees of their own funds:

- For management fees exceeding 1.2%, they are reduced to 1.2%;

- For custody fees exceeding 0.2%, they are reduced to 0.2%.

What impact does this fee reduction have on our investments?

Common fees for funds

In the A-share market, when we invest in funds, there are mainly five common types of fees.(1) Subscription Fee

Subscription fees are generally charged by fund sales organizations. Taking stock funds as an example, they are mostly in the range of 1% to 1.5%. However, many fund sales organizations currently offer discounts, typically at a rate of 10%.

(2) Redemption Fee

Redemption fees are charges incurred when investors sell their shares in a fund. These fees are typically a percentage of the amount being redeemed and can vary depending on the fund and the terms of the sales organization. Some funds may waive redemption fees after a certain holding period or under specific conditions. It's important for investors to be aware of these fees as they can impact the overall return on investment.Redemption fees, typically charged when redeeming funds, are often included in the net asset value of the fund.

Advertisement

Redemption fees are related to the length of time the investment is held.

Taking stock funds as an example, generally speaking,

- If you redeem within 7 days of purchase, there will be a punitive redemption fee of 1.5%, so it is advisable to avoid redeeming immediately after buying.

- If the holding period is more than 7 days but within 1-2 years, most funds will have a redemption fee of 0.5%.

- If the holding period is 1-2 years or more, the redemption fee will be reduced, and some funds may waive it.

(3) Management feesManagement fees are charged by the fund management organization.

Active funds typically charge 1% to 1.5% of the fund's size annually as management fees.

This fee does not need to be paid separately by us; instead, it is directly deducted from the net value of the fund.

That is to say, the net value of the fund we see on each trading day is already after the deduction of the management fee.

(4) Custody fees

Custody fees are charged by the fund custody institution.To ensure the safety of funds, the substantial assets of a fund are held in custody by a custodian institution, such as a large bank or a major securities broker.

Generally speaking, the annual custody fee for a fund is around 0.25%.

This fee does not need to be paid separately by us; instead, it is directly deducted from the net value of the fund.

Similarly, the net value of the fund that we see on each trading day has already had the custody fee deducted.

(5) Investment Advisory Fee

If you invest in a fund through an investment advisory portfolio, there will be an investment advisory fee involved, which is charged by the fund's investment advisory institution. Currently, all investment advisory portfolios charge an investment advisory fee, and there is no option to waive it.

The more common range for the investment advisory fee rate is 0.5% to 1% per annum.This is a general overview of the main fee rates for our investment in A-share funds.

Differences in Fund Fee Rates between A-shares and US stocks

The significant difference in fees is in the management fees.

- In the A-share market, active funds are about 1%-1.5% per year, and index funds are about 0.5% per year;

- In the US stock market, active funds are about 0.5% per year, and index funds are about 0.2% per year.The management fee rate of A-shares still has room for reduction in the future.

There is not much difference in other fee rates.

The impact of fee reduction on investors: saving is earning

For us investors, the reduction of fund management fees is naturally welcome news.

The fund returns we see now are the returns after deducting management fees and other expenses.

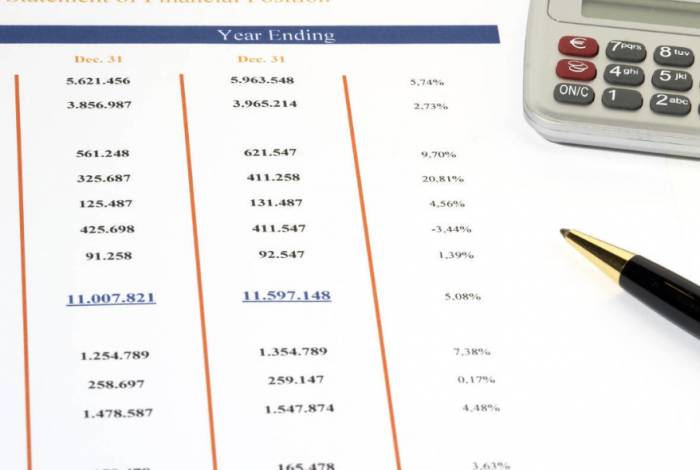

After the fee rate is reduced, the same investment strategy will yield more returns.Let's take a look at this: assuming an annualized pre-fee return of 10%, and an investment of 10,000 yuan, how much would it grow to over the long term under management fee levels of 1.5% and 1.2%?

It can be seen that, although it's a small benefit, the accumulation over time is quite significant, especially when considering long-term investments.

Saving is essentially earning.

Impact on fund companies: The leading company effect will be even stronger.For fund companies, after the reduction of fees, a situation where the strong get stronger may emerge, with the leading effect becoming more pronounced.

Management fee income is the main source of revenue for fund companies. After the reduction of fees, the income of fund companies will decrease.

However, some fixed costs, such as operational costs and labor costs, are relatively fixed.

Therefore, the profits of fund companies will also decline accordingly.

For some newly established and small to medium-sized fund companies, this point is particularly evident.The management scale of these fund companies is relatively small to begin with, and they are at a disadvantage. Moreover, they immediately face an environment with relatively low fee rates.

The difficulty of development can be imagined.

Some of the top large fund companies manage a relatively large scale, and thus are relatively less affected.

Therefore, the competitive advantage of these top large companies will become stronger, and the leading effect will be more pronounced.

The U.S. stock market is a similar situation.

In the current U.S. stock index fund market, Vanguard, BlackRock, and State Street Bank, these three companies, occupy more than 80% of the market share.Fee Reductions Signal a Long-Term Trend in the Fund Industry

This instance of fee reduction is merely the beginning. It implies a long-term trend that is:

Fees for funds will gradually decrease over time.

U.S. stock funds have also gone through a similar process.

Since their inception, the fee models for U.S. stock funds have gone through four main stages:Phase One: Subscription Fee Model

In the 1970s and 1980s, the subscription fees for U.S. stock funds were as high as 8%-9%. This means that for every $10,000 invested in a fund, without doing anything, $800-$900 would be taken by the sales organization. Such high fees are unimaginable today.

Phase Two: Management Fee Model

Later, as the industry developed and competition intensified, along with the efforts of John Bogle, the father of index funds, to promote the reduction of subscription fees, the fees were significantly lowered.The business model of funds is gradually transitioning to a management fee model.

The management fee model is beneficial for outstanding fund managers. This is because there is not much difference in management fees among different funds. However, the performance of excellent fund managers will be significantly higher than the average, making the "value for money" relatively high for investors.

Some outstanding fund managers can easily attract a large amount of capital, marking an era of celebrity fund managers.

▼Third Stage: Advisory Portfolios + Low-Fee FundsLater on, the number of funds continued to increase, even surpassing the number of stocks, making the difficulty of selecting funds greater than that of individual stocks, leading to the gradual rise of fund advisory services.

Good fund managers were fully discovered, and the difficulty for fund managers to outperform index funds gradually increased, with excess returns becoming fewer and fewer.

The industry competition became more intense, and the management fee rates for funds also began to gradually decrease.

Some funds with low fee rates, such as index funds, gradually became mainstream.

Now, the fee rates for U.S. stock funds are already relatively low.

- The average management fee rate for actively managed U.S. stock funds is less than 0.5% per year;

- The average management fee rate for index funds is less than 0.2% per year.▼Phase Four: Fixed Fee Model

Later on, several innovative financial institutions in the U.S. stock market began to experiment with a fixed fee model. This means charging a set annual fee instead of calculating it based on the scale of the assets invested. For instance, regardless of the amount invested, even if it's $100 million, the annual fee remains fixed.

This way, for large investors, the fund fees approach zero. It is a model that goes a step further than low management fee index funds. However, this area is still in the exploratory phase, and even overseas, the fixed annual fee model is just beginning to take off in the financial industry.The domestic fund industry is still in development, and fund advisory services have only emerged in recent years, similar to the U.S. stock market in the 1980s and 1990s.

If we look overseas for reference, reducing fund management fees to 1.2% will not be the end point.

In the next 10-20 years, the average management fee rate for domestic active funds may potentially decrease to around 0.5% per year, while index funds may decrease to around 0.2% per year.

Naturally, for investors, lower fees are preferable, as saving on fees is akin to earning more.

Leave a Comment